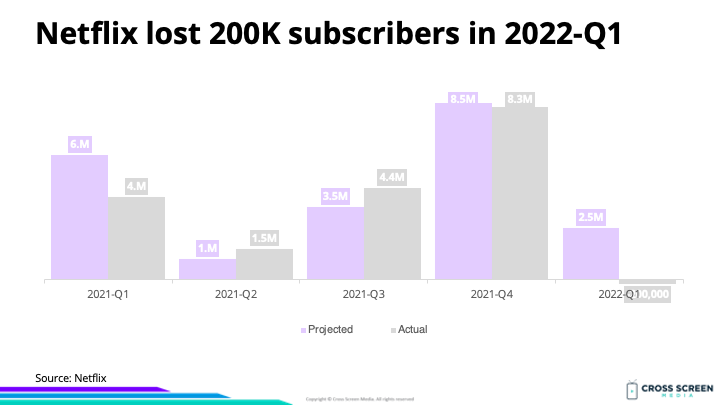

Big news: Netflix reported its first quarterly subscriber decline (↓ 200K) in more than a decade.

Netflix subscriber growth in 2022-Q1:

1) Projected – ↑ 2.5M

2) Actual – ↓ 200K

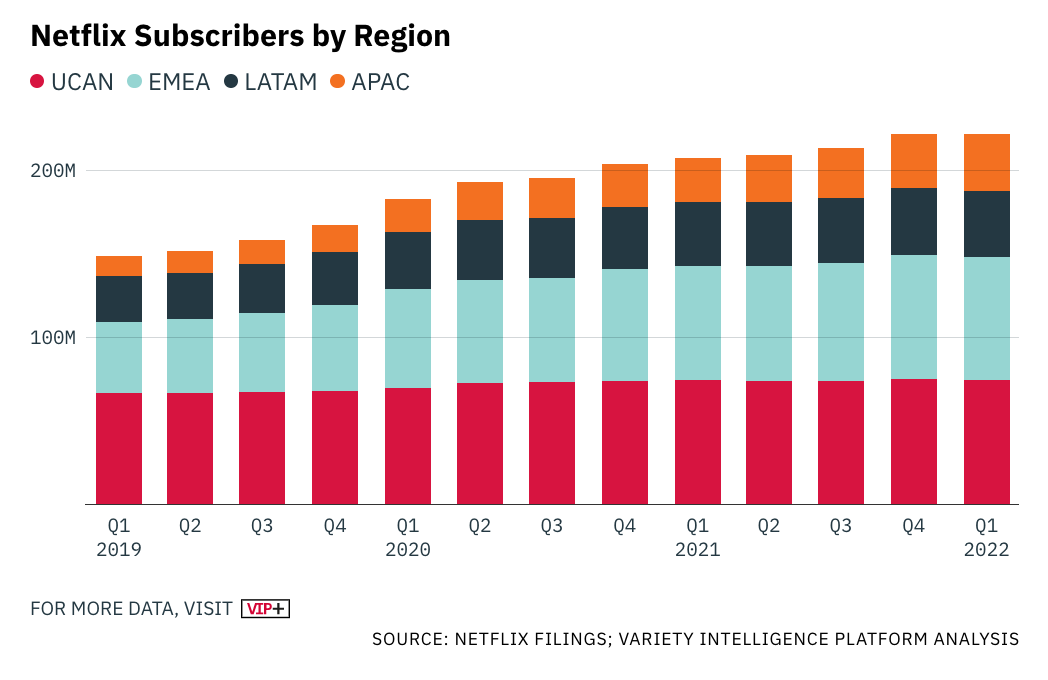

Netflix subscribers (YoY growth):

1) 2015-Q1 – 62.3M

2) 2016-Q1 – 81.5M (↑ 31%)

3) 2017-Q1 – 94.4M (↑ 16%)

4) 2018-Q1 – 118.9M (↑ 26%)

5) 2019-Q1 – 148.9M (↑ 25%)

6) 2020-Q1 – 182.9M (↑ 23%)

7) 2021-Q1 – 207.6M (↑ 14%)

8) 2022-Q1 – 221.6M (↑ 7%)

Netflix subscribers (% of total):

Netflix subscribers (% of total):

1) International – 147.1M (66%)

2) U.S./Canada – 74.6M (34%)

3) Total – 221.6M

Dive deep: What Does Netflix’s Growth Mean For Convergent TV?

Big question #1: How has Wall Street reacted?

Quick answer: Netflix’s valuation dropped ≈ $200B over the past 5 months.

Big question #2: What is their plan for growing subscribers?

Quick answer: Launching a lower-priced offering with ads.

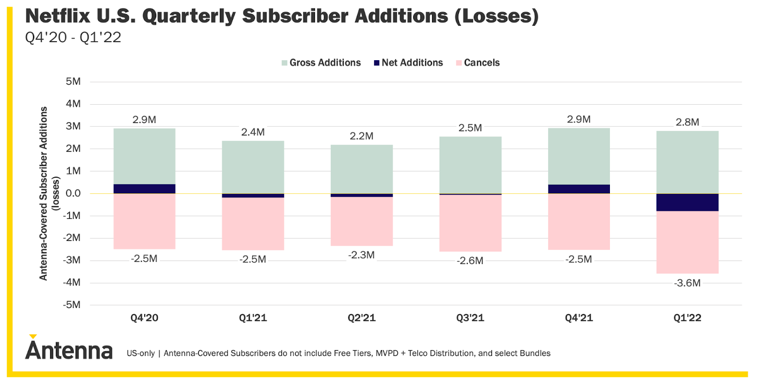

Why this matters: Two factors are impacting Netflix at the same time. First, 57% of HH in the U.S./Canada already subscribe to Netflix. Second, the growth in streaming subscriptions per household is slowing.

Big question #3: What makes an ad-supported option smart for Netflix?

Mr. Screens’ Crystal Ball: This will be a home run for Netflix. They already generate more viewing time than the average broadcast network, and demand for CTV advertising is outpacing supply.

Share of viewing time in March 2022 according to Nielsen:

1) Netflix – 6.6%

2) AVG broadcast network – 6.2%