1) The Smart TV Wars get even hotter – Roku’s battles with HBO Max/Peacock along with Comcast’s rumored partnership with Walmart made clear the strategic importance of owning distribution in the streaming era. Look for other major players (Amazon, Samsung, Vizio, Google, etc.) to start throwing more elbows in these deals.

Verdict: Mostly correct. YouTube took on a large chunk of the industry (Disney, Roku, and NBCUniversal), but the other hardware players (Vizio, Samsung, LG, etc.) stayed (mostly) out of the fray.

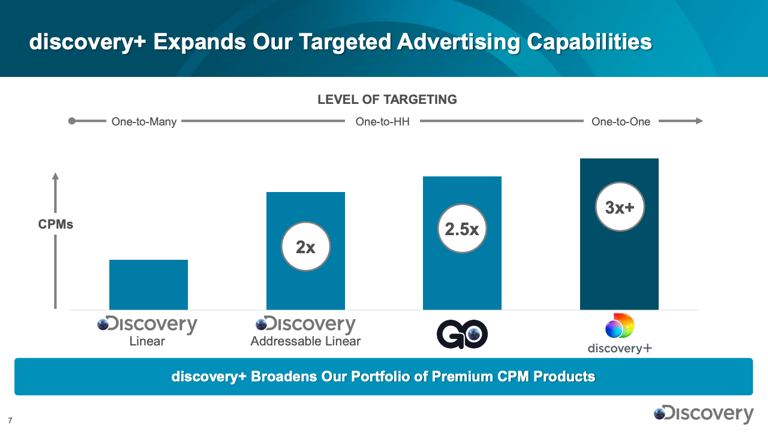

2) National addressable TV ads will drive up CTV/OTT CPMs – If national TV advertisers can purchase addressable inventory in 2021, it is our assumption CPMs will be 3X+ higher than normal linear TV. This will cause CTV/OTT advertisers to re-evaluate (increase) what they are willing to spend for an addressable ad in with a lower ad load. This is something we discussed at the Rosenblatt Securities 3rd Annual OTT/CTV Virtual Fireside and was also reflected in the Discovery+ investor presentation.

Verdict: Perhaps a bit early on this one. Targeted video advertising is undervalued, which will change as measurement improves.

3) Monthly revenue per user (ARPU) grows faster for ad-supported subscribers than ad-free – Any streaming service that launches with both an ad-free as well as an ad-supported offering should see ARPU growth for both in 2021. The ad-supported cohort will grow faster due to increased demand for ad-supported streaming and higher CPMs (see above).

Verdict: Final numbers for 2021 are not in. Using the 2021-Q3 numbers for Roku and Vizio as a proxy, this looks like a safe bet.

Monthly revenue per account in 2021-Q3 (YoY growth):

1) Roku – $3.44 (↑ 49%)

2) Vizio – $1.99 (↑ 74%)