Big news: Amazon is moving beyond licensing its smart TV OS and producing the entire TV.

Big picture: Roku and Google both license their smart TV OS, but Amazon is the first to sell a TV itself.

Why this matters: The reality of streaming TV is hardware providers are taking the place of cable TV companies as gatekeepers in distribution battles.

Shots fired: Walmart asked Vizio to remove the Amazon Prime button from the remote of any TV sold in a Walmart.

Flashback #1: Streaming Wars Moving Upstream

Flashback #2: The Smart TV Wars Heat Up

PSA: Alan Wolk and the team at TV[R]EV released a report on the smart TV ecosystem.

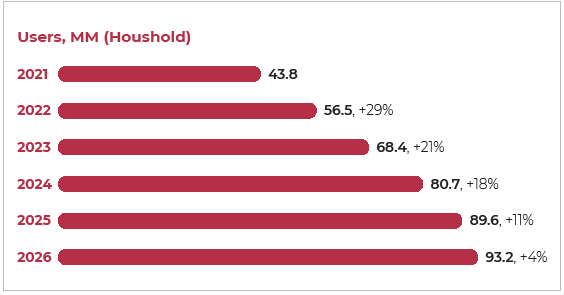

U.S. Smart TV households (YoY growth) according to TV[R]EV:

1) 2021 – 44M

2) 2022 – 57M (↑ 29%)

3) 2023 – 68M (↑ 21%)

4) 2024 – 81M (↑ 18%)

5) 2025 – 90M (↑ 11%)

6) 2026 – 93M (↑ 4%)

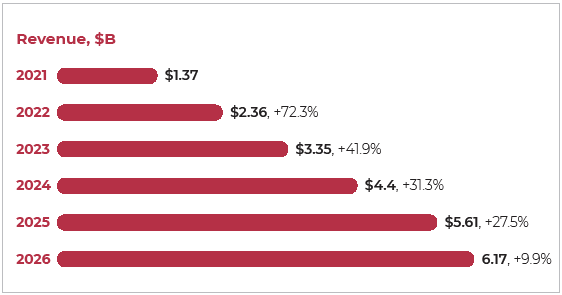

U.S. Smart TV ad revenue (YoY growth):

1) 2021 – $1.4B

2) 2022 – $2.4B (↑ 72%)

3) 2023 – $3.4B (↑ 42%)

4) 2024 – $4.4B (↑ 31%)

5) 2025 – $5.6B (↑ 28%)

6) 2026 – $6.2B (↑ 10%)

Mr. Screen’s Crystal Ball: Amazon could quickly grow share by pricing their smart TV well below their competition. The TV would serve as a loss leader, and they would turn a profit on advertising.

Quick math: The TV[R]EV projection would lead to the average smart TV household generating $305 in ad revenue between 2021-26. My guess is this will turn out to be wildly low as more marketers prioritize audience targeting and measurement.

U.S. Smart TV ad revenue per household (YoY growth):

1) 2021 – $31.28

2) 2022 – $41.77 (↑ 34%)

3) 2023 – $48.98 (↑ 17%)

4) 2024 – $54.52 (↑ 11%)

5) 2025 – $62.61 (↑ 15%)

6) 2026 – $66.20 (↑ 6%)

Video: Amazon TV is the next step for company to move into internet of things: Analyst