Discovery+ subscribers (YoY growth):

1) 2020 – 5.2M

2) 2021 – 22.0M (↑ 323%)

Big news: Discovery and WarnerMedia may complete their merger by the end of this quarter.

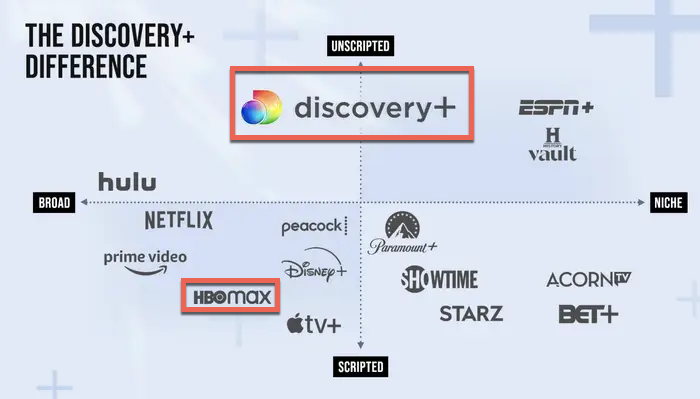

Big question #1: What will WarnerBros. Discovery cost?

Potential subscription tiers for WarnerBros. Discovery:

1) Free w/ ads

2) Lower cost subscription w/ some ads

3) Higher cost subscription with no ads

Quote from David Zaslav – CEO @ Discovery:

“Our objective is to reach everybody. There’s a load of people that will never pay for television, but they can go to and view this content and that’ll be advertiser-supported. I think there are a number of players that are very tied to this idea of subscription-only.”

Flashback: Welcome To The Jungle: Discovery Betting On New Streaming Service

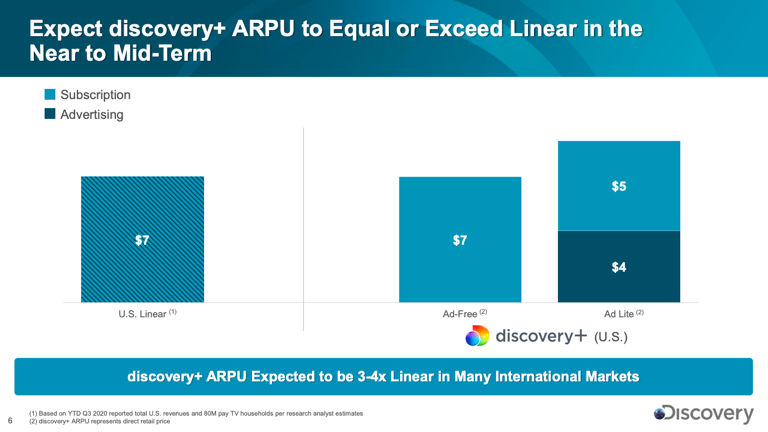

Monthly ARPU for Discovery:

1) Discovery+ (ad-supported) – $9

2) Discovery+ (ad-free) – $7

3) Discovery linear (ad-supported) – $7

FYI: The combined company will generate ≈ $10B in linear/streaming ad revenue.

Big question #2: Will WarnerBros Discovery lead the spending race for content?

Quick answer: No.

Quote from David Zaslav – CEO @ Discovery:

“Our goal is to compete with the leading streaming services, not to win the spending war.”

Estimated U.S. content spend for WarnerBros. Discovery (YoY growth) according to Wells Fargo:

1) 2019 – $19.8B

2) 2020 – $18.0B (↓ 9%)

3) 2021 – $20.7B (↑ 15%)

4) 2022P – $22.4B (↑ 8%)

5) 2023P – $24.0B (↑ 7%)

6) 2024P – $25.2B (↑ 5%)

7) 2025P – $26.2B (↑ 4%)

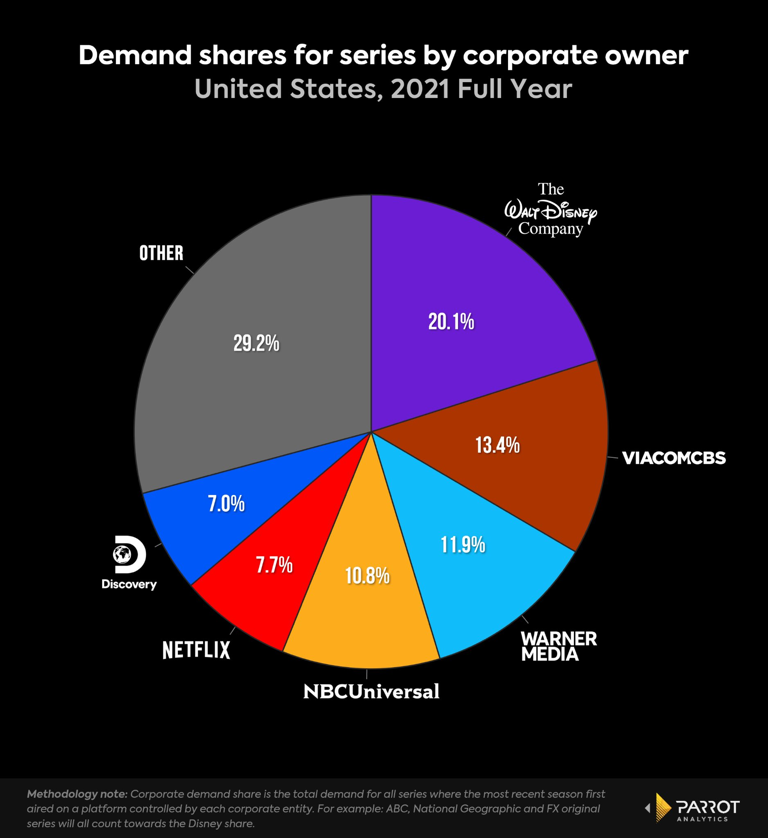

Share of series demand according to Parrot Analytics:

1) Disney – 20%

2) WarnerBros. Discovery – 19%

3) Viacom – 13%

4) NBCUniversal – 11%

5) Netflix – 8%

6) Other – 29%