Big News: The next phase of conference realignment in college football has started with Texas and Oklahoma leaving the Big 12 for the SEC.

Why this matters: The need for scale leads to consolidation in the entertainment sector (Discovery + WarnerMedia, etc.). Big-time college athletics is no different. Adding Texas and Oklahoma to the SEC will lead to even larger media rights deals along with greater potential for a direct-to-consumer offering.

NCAA football advertising revenue by network (% of total) according to iSpot:

1) ABC/ESPN – $1.2B (25%)

2) Fox – $280M (6%)

3) CBS – $173M (3%)

4) NBC – $52M (1%)

Smart take: Andy Staples from the Athletic coined the term the “four million club” referring to games that draw 4M+ viewers.

Quick math on four million club:

1) 1,593 televised games between 2015-19

2) 198 (12%) topped 4M+ viewers

3) 13 schools played in 10+ games

Teams with most four million club games:

1) Alabama – 35

2) Ohio State – 31

3) Michigan – 26

4) Auburn – 17

5) Notre Dame – 17

6) Florida – 16

7) LSU – 16

8) Clemson – 15

9) Georgia – 15

10) Oklahoma – 14

Bottom line: Networks will pay conferences a premium for games with 4M+ viewers, and the SEC will now be able to offer more of them. Conferences can turn around and distribute more to member schools.

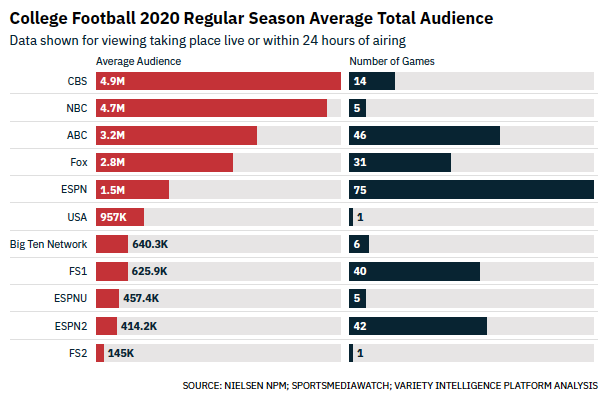

2020 college football viewers by network according to Variety:

1) CBS – 4.9M

2) NBC – 4.7M

3) ABC – 3.2M

4) Fox – 2.8M

5) ESPN – 1.5M

Annual value (% change) of SEC TV contract according to Sports Business Journal:

1) Current (CBS) – $55M

2) Future (ESPN) – $300M (↑ 445%)

Flashback: Fox Warns The Big Ten Deal With Comcast is Expiring

Monthly revenue/subscriber for Big Ten Network:

1) Big Ten market – $1.30

2) Non-Big Ten market – ≈ $0.10

3) Average – $0.56